How to start aligning your processes with SFDR 2.0 requirements

In our latest regulatory update by Altum Groups, Margherita Balerna-Bommartini, read more about what asset managers must do now ahead of the key changes and compliance deadlines.

Key changes under SFDR 2.0

1. New product categories

Articles 8 & 9 will be replaced by three categories: Transition, ESG Basics, and Sustainable, each with strict eligibility rules.

2. Minimum investment thresholds

At least 70% of assets must align with category criteria; and the Sustainable category requires 15% Taxonomy alignment.

3. Mandatory exclusions

Fossil fuels and other non-compliant sectors will be excluded; Paris-aligned benchmark exclusions will apply.

4. Simplified disclosures

Pre-contractual and periodic reports will be capped at two pages; including streamlined website disclosures.

5. Removal of DNSH & Governance Tests

“Do No Significant Harm” and governance checks will be replaced by binding exclusions and qualifying criteria.

6. Recognition of impact products

Funds with measurable social or environmental impact face additional disclosure obligations.

7. Marketing restrictions

Non-categorised products cannot use ESG terms in names or marketing; sustainability claims must be substantiated.

8. Implementation timeline

Expected application by December 2028, with an 18-month transition after publication (anticipated mid-2027).

What is the key impact for asset managers

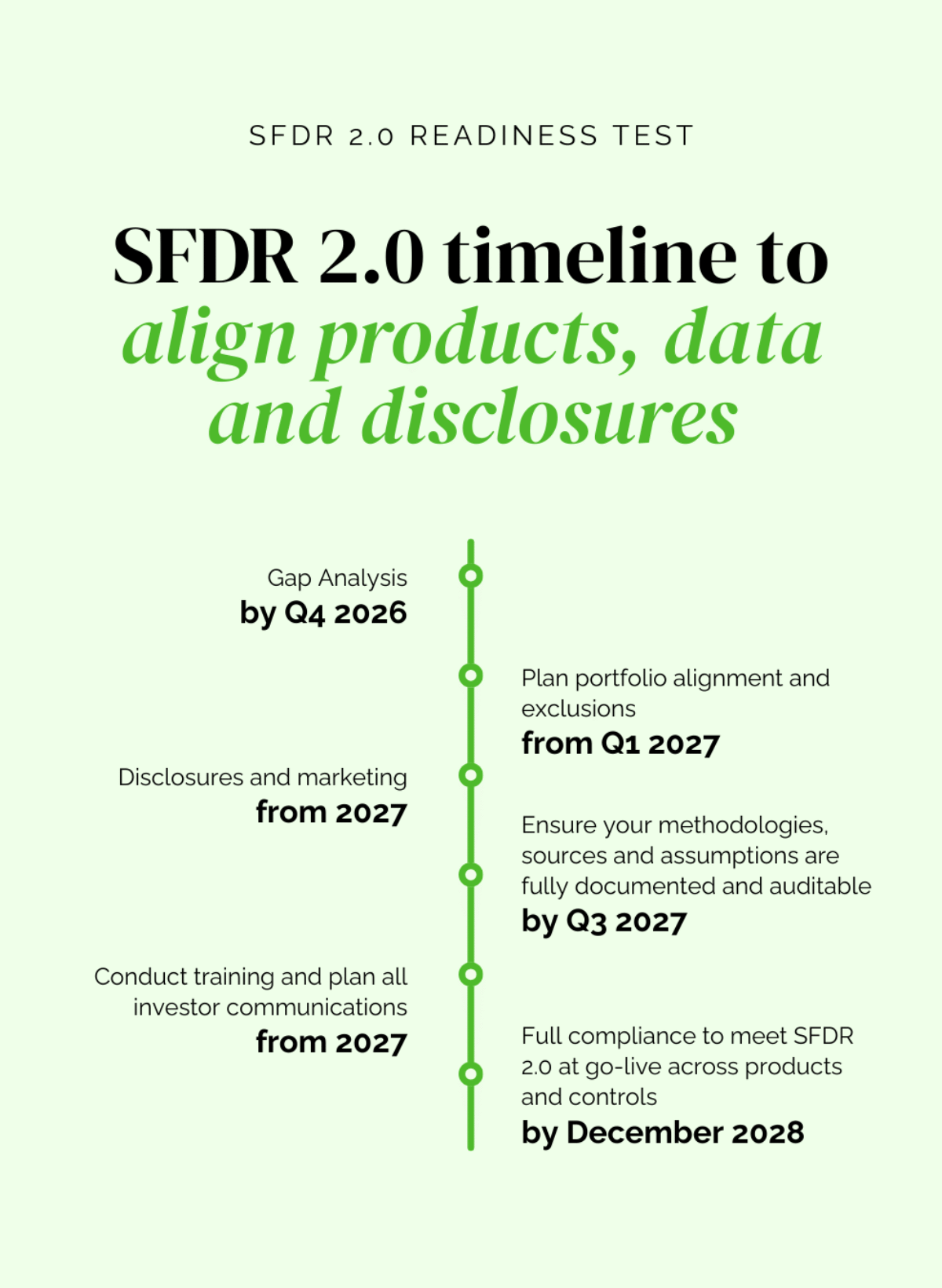

Actions and timeline

- Gap Analysis – Assess current fund classification vs. new categories by Q4 2026.

- Portfolio Strategy Review – Plan asset alignment and exclusions from Q1 2027.

- Update Disclosures & Marketing – Prepare new templates and remove non-compliant ESG claims by mid-2027.

- Data Governance Framework – Document methodologies and sources for sustainability data by Q3 2027.

- Staff Training & Client Communication – Implement training and investor updates – ongoing from 2027.

- Full Compliance – SFDR 2.0 effective by December 2028.

How an AIFM and Management Company can support you:

- Regulatory Expertise: Interpret SFDR 2.0 requirements, liaise with CSSF, and ensure compliance with EU standards.

- Portfolio Oversight & Risk Management: Monitor adherence to 70% thresholds, exclusions, and transition objectives.

- Disclosure & Reporting: Prepare compliant pre-contractual and periodic reports; manage CSSF filings.

- Data Management: Implement robust ESG data governance and documentation processes.

- Operational Efficiency: Offer substance and infrastructure for EU passporting, reducing time-to-market for reclassified funds.

- Investor Communication: Support marketing compliance and ESG claim substantiation.

Altum Management Company (Luxembourg) S.A. provides a full suite of services that map directly onto the strategic, operational, governance and data related demands of SFDR 2.0. Speak to our experts on how we can support you with project assessments, setup and launch for your UCITS, SIF, RAIF and AIF structures.